In August (2025), the Committee on Foreign Investment in the United States (“CFIUS” or the “Committee”) released its annual report to congress for the calendar year (CY) 2024.

Here’s what we find notable about the data and trends as provided by CFIUS for this report. Please note we have divided our analysis of the data for declaration filings and “long-form” joint voluntary notices (“JVNs”) into separate sections for clarity:

Key Facts on 2024 Declaration Filings

- CFIUS reviewed 116 declarations in CY 2024 – a slight increase from the 109 filed in CY 2023. (2023 represented a dramatic fall-off from 2021 and 2022’s filed declaration numbers of 164 and 154, respectively). Japan overtook Canada as the top filer of declarations with 16 in 2024. (Canada had 11 in 2024).

|

Ranking |

2024 Country |

2024 Number of Declarations Filed |

2023 Country |

2023 Number of Declarations Filed |

|

1 |

Japan | 16 | Canada | 13 |

|

2 |

Canada | 11 | France / Japan * | 11 |

|

3 |

France / UK * | 9 | UK | 10 |

|

4 |

Germany | 8 | Australia / South Korea * | 7 |

|

5 |

United Arab Emirates | 7 | Germany | 6 |

* Indicates a tie in number of filings by two countries

- For the second year in a row, there were only two Chinese transactions filed as declarations. This trend of low declaration numbers for China (PRC) (five in 2022, and two in each of 2023 and 2024) demonstrates that PRC filers are aware that their chances of clearing a deal within the abbreviated CFIUS declaration process remain slim – and that the parties in PRC-related transactions are often better served by filing JVNs, as evidenced by the far higher number of JVNs filed by PRC in 2024 (see discussion in the JVN section below).

Of the 116 declarations, 17 (~15%) resulted in a request from CFIUS to submit a JVN filing in 2024, reinforcing an ongoing view that most parties have carefully assessed the declaration filing option strategy. Given the risk that CFIUS can ask for a JVN at the end of the 30-day review, declarations are intended for only the most straightforward cases that will likely raise minimal issues to diligence by CFIUS (e.g., internal reorganizations). Some declarations are, of course, mandatory, including foreign government-controlled investments, but parties always have the option to submit a JVN in lieu of a declaration, which is commonly used because mandatory filings involve the more sensitive “TID US businesses.” (Note that CFIUS was “unable to conclude action” on 7 declarations in 2024 (6% of the 116 declarations filed); in 2023, the number was 6. The report does not provide statistics on the number of these transactions that were re-filed as JVNs.)

Key Facts about 2024 JVN Filings

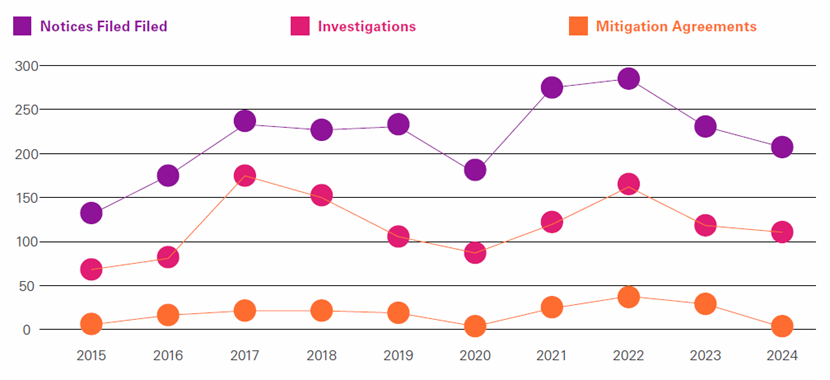

- The number of JVNs filed in CY 2024, 209, continues a downward trend from 2022’s record number of 286 and 2023’s number of 233. PRC is at the top for filer of JVNs, with 26 total, closely followed by France and Japan, with 25 and 24, respectively.

|

Ranking |

2024 Country |

2024 Number of JVNs Filed |

2023 Country |

2023 Number of JVNs Filed |

|

1 |

PRC | 26 | PRC | 33 |

|

2 |

France / Japan * |

23 | United Arab Emirates | 22 |

|

3 |

United Arab Emirates | 21 | Singapore / UK | 19 |

|

4 |

Singapore | 14 | Canada * | 16 |

|

5 |

Canada / Germany * | 12 | Japan | 15 |

* Indicates a tie in number of filings by two countries

- In 16 of the 2024 JVNs, CFIUS concluded its review after adopting mitigation measures to resolve national security concerns. The report notes that conditions were imposed on an additional six JVNs that were withdrawn and their transactions abandoned. (Note: CFIUS must agree to grant a withdrawal, and the imposition of conditions with a withdrawal is a common occurrence.)

- Forty-nine of these 209 JVNs were withdrawn by the parties after commencement of a CFIUS investigation (roughly 23%). There are any number of reasons why this occurs – the most common being because CFIUS or the parties need more time than the investigation period allows: In 42 of these cases, the parties resubmitted their JVNs (31 re-filed in 2024 and 11 in 2025). In seven cases, however, the parties withdrew their JVNs and then abandoned the transactions, either for commercial reasons or because CFIUS told the parties it could not find mitigation measures that would resolve its national security concerns or because the parties refused to accept proposed mitigation measures.

- In 2024, as in 2023, CFIUS’s non-notified transaction enforcement team “preliminarily considered thousands of potential non-notified transactions.” Of these, 76 non-notified transactions were opened for inquiry by CFIUS for potential review, 17 (about one out of five cases) of which resulted in filings to CFIUS. CFIUS’s non-notified team continues to increase its efforts, year over year, in tracking down cases of interest that have not been filed. Again, this serves as a warning to transaction parties to carefully consider their exposure – even a seemingly innocuous foreign investment could raise CFIUS interest and, as such, parties should conduct appropriate CFIUS diligence. As evident, however, by the thousands of cases reviewed by the non-notified team, a CFIUS filing is likely not warranted for many cases, but risks remain for those few that result in a CFIUS inquiry, particularly if it occurs after closing when the risk shifts, often entirely, to the investor.

Key Facts on 2024 Declaration Filings

- CFIUS reviewed 116 declarations in CY 2024 – a slight increase from the 109 filed in CY 2023. (2023 represented a dramatic fall-off from 2021 and 2022’s filed declaration numbers of 164 and 154, respectively). Japan overtook Canada as the top filer of declarations with 16 in 2024. (Canada had 11 in 2024).

|

Top Five Investor Country Names |

Number of Filings (JVNs + Declarations) for 2024 |

Percentage of Total Filings for 2024 (out of 325) |

| Japan | 39 filings | 12.30% |

| France |

32 filings | 10.50% |

| PRC | 28 filings | 8.60% |

| United Arab Emirates | 28 filings | 8.60% |

| Singapore | 19 filings | 5.80% |

- Also notable in 2024 were the presidential decisions issued for two CFIUS-reviewed transactions:

- (1) In May of 2024, President Biden imposed an order requiring the removal of equipment, and the divestment of real estate by MineOne Partners Limited and its affiliates, a cryptocurrency mining company ultimately owned by Chinese nationals. This is the first presidential order stemming from CFIUS’s more recent real estate authorities granted under the 2018 Foreign Investment Risk Review Modernization Act (FIRRMA) legislation.

- (2) The proposed acquisition of US Steel Corporation by Japanese steel manufacturer Nippon Steel was blocked by President Biden after a CFIUS review and recommendation in December 2024. In 2025, however, CFIUS reopened its review of the US Steel-Nippon transaction and ultimately cleared the transaction following the parties’ agreement to a national security agreement (see our summary of this case here).

Key Facts about 2024 JVN Filings

The Annual Report for CY 2024 is 60 pages long, and transaction parties contemplating filing with CFIUS always are welladvised to coordinate with experienced CFIUS counsel when considering how the data and trends outlined within these pages may be applicable to their transactions, as when weighing the shifting national security and foreign policy priorities that may impact their risks. Each transaction presents its own challenges. As with any regulatory risk in the M&A process, diligence preparation is crucial to limiting deal risk and timing uncertainties.

For more information, please contact any of the following members of Squire Patton Boggs’s International Trade and Foreign Investment Group.