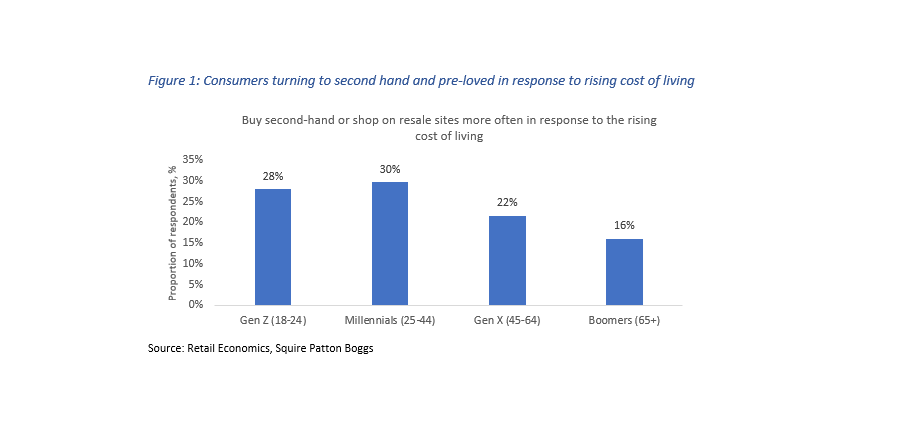

As the cost-of-living crisis takes hold, new research from Squire Patton Boggs shows Brits are turning to second-hand options to save money, providing a welcome boost in the push to more sustainable shopping.

Almost a quarter of UK consumers - around seven million households - plan to buy second-hand or shop on re-sale sites more often in response to the rising cost of living.

The fast-growing ‘pre-loved’ market offers an affordable shopping option to cash strapped shoppers, but also meets strong desire from conscious consumers to minimise their impact on the environment.

Shopping around for deals

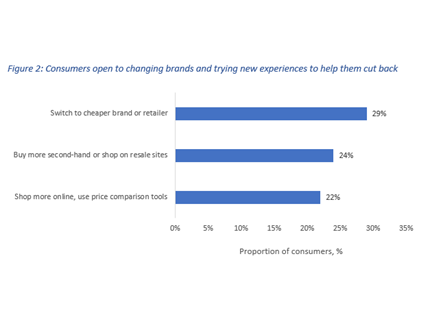

As consumers adopt a savvier approach to their spending, they are becoming more open to changing brands, channels and trying out new or different shopping experiences.

Around one in three shoppers are consciously looking to switch to cheaper brands or retailers, while one in four plan to research more online and use price comparison tools before committing to a purchase.

But brand reputation is an area that shoppers appear unwilling to compromise on. Three quarters (78%) of consumers would not switch to a cheaper brand if their company values were not aligned to their own.

Younger shoppers are particularly driven by a desire to ‘do good’ when shopping, with over two thirds of Gen Zs considering ethical and environmental credentials an important factor when choosing a brand, more than any other age group.

Consumers cutting back

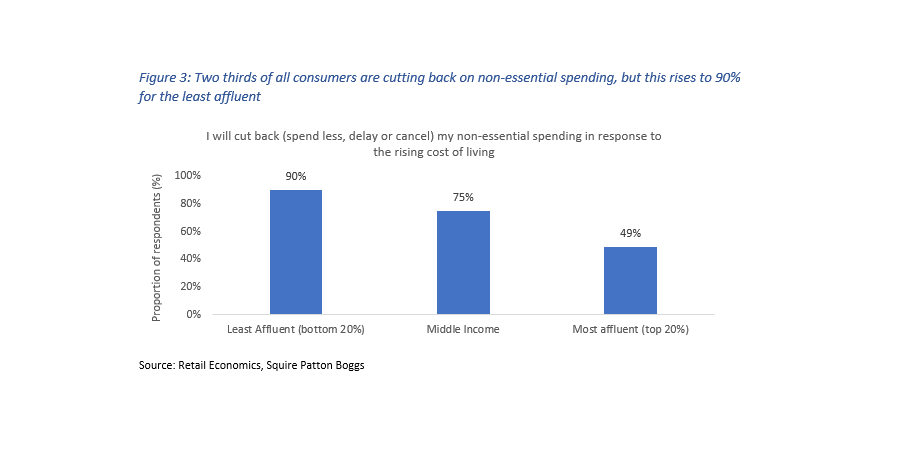

Overall, the research shows that more than two-thirds (68%) of consumers plan to spend less on non-essential goods and services this year.

Concerningly for retail and leisure industries, over a quarter (29%) say they plan to stop buying non-essentials such as holidays, furniture and electrical items altogether.

The severity of the cut back varies by household, with the research showing that the least affluent households are almost twice more likely to sacrifice non-essentials than the most affluent as economic pressures mount.

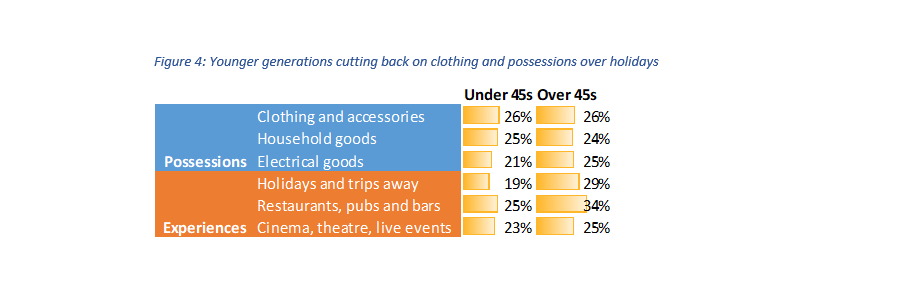

Generational divide in cut-back priorities

Cut-back priorities differ widely by generation. Gen Z and Millennials are more open to cutting back on material goods than experiences such as holidays and dining out. This shows there is still significant pent-up demand from younger generations for travel and socialising after two years of pandemic restrictions.

Whereas leisure-based spending and experiences hold less value to consumers over 45, with restaurants, pubs and bars chosen as the first area they intend to cut back on.

Consumers still expect meaningful experiences

During the pandemic, many shoppers bought more consciously, locally, and embraced online, heightening their expectations of retailers.

A third of consumers surveyed said that the pandemic has permanently raised their expectations when shopping, while nearly a quarter (24%) would happily pay more in return for a better or more memorable shopping experience, despite already high inflation.

This shows consumer perception of value for money encompasses much more than price. For example, 88% of shoppers would not be prepared to pay less if it meant receiving inferior customer service such as fewer staff available to help.

Balancing act for consumers

As inflationary pressures intensify, consumers face a balancing act between making the most of post-pandemic freedoms and managing their finances.

The research shows a third of UK consumers are looking for some form of Escapism from their retail and leisure experiences in 2022, compared to just one in five (22%) before the pandemic.

The lifting of COVID-19 restrictions has unleashed significant pent-up demand for socialising, travel, and other leisure activities, fuelling a renaissance of the experience economy.

Additionally, geopolitical conflict and fears of recession means consumers are also looking for experiences that provide some ‘down time’ from such concerns.

Matthew Lewis, head of the Retail Industry Group at Squire Patton Boggs, says: “After a turbulent few years and continuing concerns about cost of living, the retail sector has undergone a significant shift and it is no surprise that consumer interests have significantly changed since pre-pandemic, as is borne out by our research.

“For non-essential purchases, consumers are seeking new experiences that offer some form of escapism from their daily routines, while the rising cost of living is forcing consumers to trade-off between essentials and luxuries. Simultaneously, retailers are juggling critical issues such as the war on talent, ESG reporting and the need to remain competitive.

“Our report, created in partnership with Retail Economics, is intended to provide retailers with a comprehensive view of market trends, in order to pro-actively tackle the challenges, and harness the opportunities that lay ahead. We hope this will be a valuable resource for retailers as we all plan our way to a brighter future.”

Richard Lim, Chief Executive of Retail Economics, says: “As household budgets become squeezed, empathetic and meaningful communication can be a highly effective tool for brands to build loyalty and achieve a competitive advantage. However, striking the right tone with shoppers reverberates far beyond the cost-of-living crisis.

“This research shows consumers are paying closer attention to how companies treat their employees and the environment, as well as their customers – and in some cases, are willing to pay extra to reward companies that ‘do the right thing’.

“The ability to tell a compelling ESG story has become increasingly important to consumers and can be a differentiator of choice for many. This has significant implications for how brands connect with consumers, on what platforms, while tailoring a personalised narrative that strongly resonates with them.”